The forces driving growth of the African Tech ecosystem have prevailed against the headwinds-Partech Report

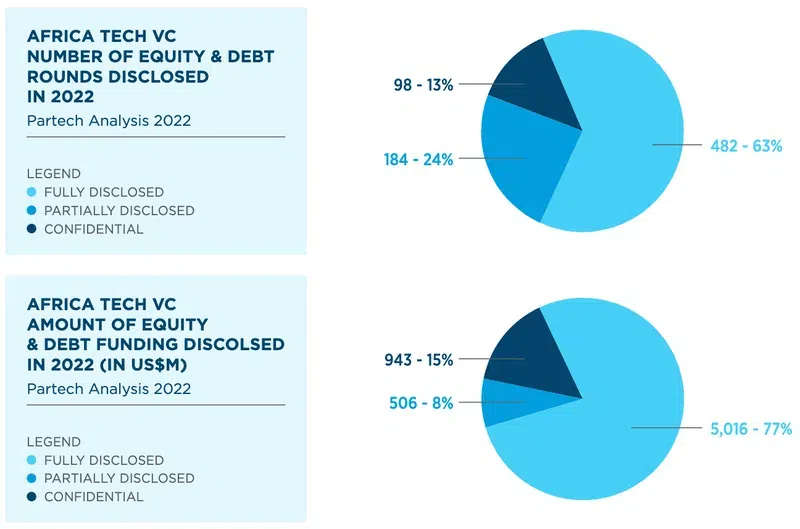

the African Tech ecosystem has continued to grow in 2022, despite a global economic crisis and a dramatic slowdown in the venture capital landscape. Funding for the African sector grew +8% to US$6.5B, through 764 rounds, with debt funding doubling in the year (+102% to US$1.5B in 71 rounds) to compensate for a slight decline in equity rounds (-6% to US$4.9B in 693 rounds).

The African Tech sector was one of the very few, if not the only, VC markets to boast net growth funding in 2022. Globally, VC funding fell by 35% over the same period.

However, looking closely at the figures, this market was not left unscathed. We can see the slowdown began to seep into the African market in the first quarter of the year, with a 14% drop in activity compared to the last three months of 2021. Despite this, African start-ups still closed record funding in the first half of the year. In Q3, the slowdown really kicked in, with a year-on-year decrease in the number of deals and funding raised.

Still, looking back, we can only marvel at the dynamics of this market:

- The forces of growth driving the African Tech ecosystem were strong enough to compensate for the global crisis and leave us in 2022 with total numbers similar to those of 2021 (a year everybody will agree was an outlier).

- Early-stage activity was maintained with 600+ deals in Seed+ and Series A, building up the first stage of the rocket.

- A new milestone was set with more than 1,000 (1,149) unique investors investing in Africa, cementing the growing global interest in African start-ups. Even better, we saw more local investors dominating the charts at Seed and even at Series A stages.

The future, of course, is still unknown. Has the downturn impact reached its lowest point? What has the impact of the slowdown been on valuations? Will there be more consolidations?

Well, this report cannot answer these... yet. But what is reassuring are the strong fundamentals at play: a strong talent pool and resilient entrepreneurial environment, ubiquitous access and the digitization of key sectors.

2022 was a particularly tumultuous year for the VC ecosystem, with global funding down -35% vs 20211. By comparison, Africa’s performance was fairly strong. Total funding (equity and debt) increased by 8% YoY to US$6.5B, and 764 deals were completed this year, representing a 6% increase YoY.

As 2021 was an outlier, we were watching for a correction in 2022 – and how any correction would affect the growth of the African ecosystem. It turns out the deeper growth trends, essential for Africa, were just strong enough to prevail.

One particular trend was key: African tech start-ups’ growing access to debt funding, which doubled in volume to US$1.5B, nearly a quarter of the total. It is another sign of growth and maturity for African start-ups.

Looking back over the last few years, we can see how the activity (deal counts) kept growing even during COVID in 2020 and the downturn of 2022. This points to a strong, early stage dealflow that builds on fundamentals (e.g. talent pool, entrepreneurial environment, ubiquitous access and digitization of key sectors etc.). The result has been a Compound Annual Growth Rate (CAGR) of 42% in activity since 2018.

A similar perspective on total funding amounts rather than deal counts still confirms this consistent growth. Despite a dip in 2020 during COVID, the ecosystem has not stopped growing, with a CAGR of 46% in funding volume since 2018: a 4.5x multiple over four years.

It’s too early to tell how this strong overall growth in the African tech ecosystem will hold as the downturn is still unfolding, but the sector’s strong fundamentals are likely to maintain the progress made in recent years.